Lender Pre-Approval A 'Must' In A Competitive Market

In many markets across the country, the number of buyers searching for their dream homes outnumbers the number of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show that you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.

Even if you are not in an incredibly competitive market, understanding your budget will give you the confidence of knowing whether or not your dream home is within your reach. Many people searching for a new home over or under estimate what they really are comfortable with and start researching homes for sale that might be under or over their budget. This can delay the home buying process.

Freddie Mac lays out the advantages of pre-approval in the ‘My Home’ section of their website:

“It’s highly recommended that you work with your lender to get pre-approved before you begin house hunting. Pre-approval will tell you how much home you can afford and can help you move faster, and with greater confidence, in competitive markets.”

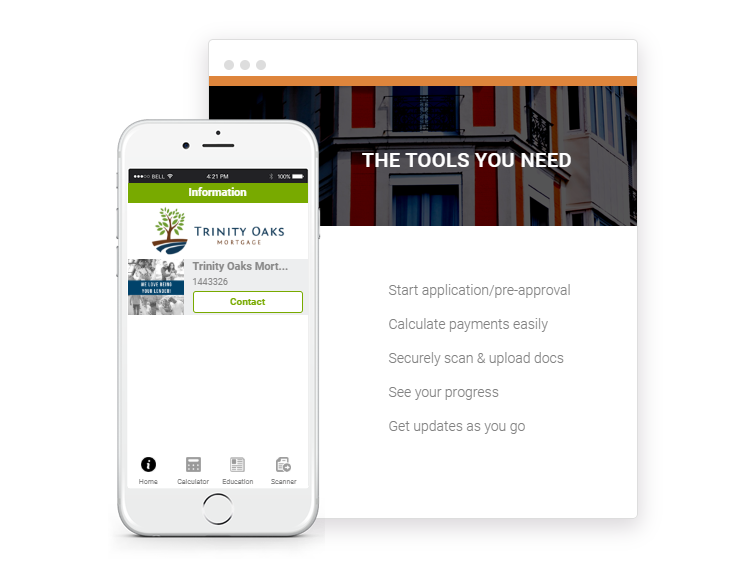

Luckily, the pre-approval or pre-qualification process is fairly pain-free. Many lenders have an online pre-approval process that can be done easily from the comfort of your own home. They even have useful tools, such as a mobile app with mortgage calculator and document scanner to make pre-approvals lightning fast.

One of the many advantages of working with a local real estate professional is that many have relationships with lenders who will be able to help you through this process. Once you have selected a lender, you will need to fill out their loan application and provide them with important information regarding “your credit, debt, work history, down payment and residential history.”

Freddie Mac describes the ‘4 Cs’ that help determine the amount you will be qualified to borrow:

- Capacity: Your current and future ability to make your payments

- Capital or cash reserves: The money, savings, and investments you have that can be sold quickly for cash

- Collateral: The home, or type of home, that you would like to purchase

- Credit: Your history of paying bills and other debts on time

Getting pre-approved is one of many steps that will show home sellers that you are serious about buying, and it often helps speed up the process once your offer has been accepted.

Why Mortgage Loan Pre-Qualification Is Important

Many potential homebuyers overestimate the down payment and credit scores necessary to qualify for a mortgage. If you are ready and willing to buy, you may be pleasantly surprised at your ability to do so today.

If you have additional questions about getting approved for a new home loan, please call us with your questions at 866-646-6008 or email us at info@jhoustonhomes.com